Easy Loans Ontario: Simplified Approaches to Financial Backing

Wiki Article

Unlock Your Financial Potential With Convenient Car Loan Services You Can Trust Fund

In the realm of individual finance, the accessibility of convenient funding solutions can be a game-changer for people making every effort to unlock their monetary capacity. When looking for financial support, the dependability and credibility of the financing service provider are vital factors to consider. A myriad of car loan choices exist, each with its very own set of benefits and considerations. Understanding exactly how to browse this landscape can make a considerable distinction in accomplishing your economic objectives. As we check out the realm of convenient financings and relied on services even more, we discover crucial insights that can encourage people to make enlightened decisions and secure a stable financial future.Benefits of Hassle-Free Loans

Convenient finances offer customers a effective and structured means to access financial aid without unnecessary problems or hold-ups. One of the key benefits of convenient loans is the quick approval procedure. Typical loans typically require prolonged documents and approval durations, creating delays for people in immediate requirement of funds. On the other hand, easy finances focus on rate and convenience, offering borrowers with rapid accessibility to the cash they need. This expedited process can be particularly helpful during emergency situations or unanticipated monetary circumstances.

Moreover, hassle-free loans typically have minimal eligibility standards, making them easily accessible to a broader variety of individuals. Typical lenders often call for substantial paperwork, high debt scores, or collateral, which can exclude numerous potential consumers. Convenient car loans, on the various other hand, focus on price and adaptability, offering assistance to people who might not meet the strict needs of traditional banks.

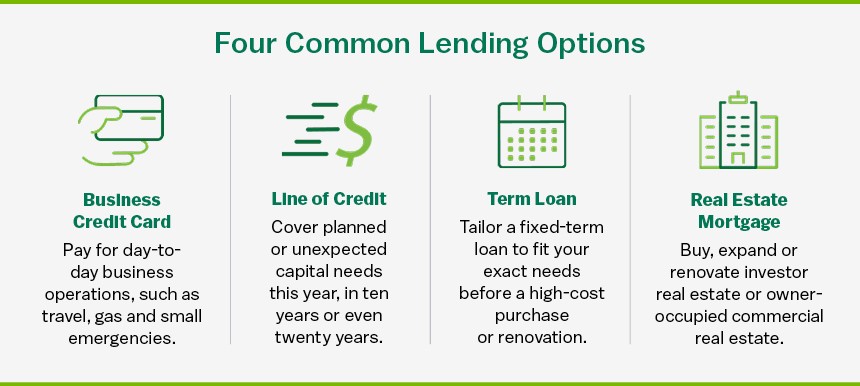

Kinds Of Trustworthy Finance Solutions

Exactly How to Receive a Loan

Exploring the essential eligibility standards is crucial for individuals looking for to certify for a car loan in today's monetary landscape. Lenders usually evaluate several variables when identifying a debtor's eligibility for a car loan. Among the primary considerations is the candidate's credit history. A good credit rating shows a history of liable financial behavior, making the consumer much less risky in the eyes of the lender. Earnings and work standing likewise play a significant role in the financing approval process (personal loans ontario). Lenders require assurance that the consumer has a steady revenue to pay off the lending on schedule. In addition, the debt-to-income ratio is a critical statistics that lending institutions use to examine a person's ability to take care of added debt. Giving precise and updated economic details, such as tax returns and financial institution statements, is necessary when making an application for a car loan. By recognizing and meeting these eligibility criteria, people can enhance their chances of receiving a car loan and accessing the economic assistance they require.Managing Finance Repayments Intelligently

When debtors efficiently safeguard a car loan by satisfying the vital qualification criteria, sensible administration of loan repayments becomes critical for preserving monetary stability and creditworthiness. To take care of car loan payments wisely, customers must develop a budget that consists of the month-to-month settlement quantity. By managing finance settlements responsibly, borrowers can not just meet their monetary commitments yet also build a positive credit scores history that can profit them in future monetary ventures.Tips for Choosing the Right Funding Choice

Choosing one of the most ideal car loan alternative includes complete research study and factor to consider of private economic demands and scenarios. To begin, assess your economic circumstance, consisting of earnings, expenditures, credit report, and existing financial debts. Comprehending these elements will certainly assist you figure out the type and quantity of funding you can manage. Next off, compare finance choices from different lenders, consisting of traditional financial institutions, cooperative credit union, and online lending institutions, to locate the very best terms and rate of interest. Think about the car loan's total price, settlement terms, and any type of extra fees linked with the financing.Additionally, it's vital to select a funding that straightens with your economic objectives. As an example, if you require funds for a details purpose like home improvement or financial obligation loan consolidation, decide for a loan that fulfills those needs. In addition, read the financing arrangement very carefully, ensuring you understand all terms prior to signing. Seek guidance from financial professionals if required to guarantee you make an educated decision that fits your monetary situations. By following these tips, you can confidently choose the appropriate financing option that helps you attain your monetary purposes.

Final Thought

Finally, opening your economic possibility have a peek here with hassle-free car loan services that you can trust is a smart and responsible choice. By understanding the benefits of these car loans, recognizing just how to receive them, handling repayments wisely, and picking the best funding option, you can attain your economic objectives with confidence and comfort. Trustworthy loan services can offer the assistance you require to take control of view publisher site your financial resources and reach your preferred outcomes.Protected financings, such as home equity financings or auto title fundings, permit customers to make use of collateral to protect reduced rate of interest prices, making them a suitable option for individuals with valuable possessions.When consumers successfully secure a financing by meeting the crucial qualification requirements, prudent administration of finance repayments comes to be extremely important for maintaining monetary security and credit reliability. By managing loan payments sensibly, consumers can not only meet their economic commitments but also develop a read more positive debt background that can profit them in future economic undertakings.

Consider the lending's total expense, settlement terms, and any type of extra costs linked with the financing.

Report this wiki page